owe state taxes from unemployment

All of these people will have to report the. Rhode Island taxes unemployment compensation to the same extent that its taxed under federal law.

Unemployment And Withholding Taxes Homeunemployed Com

Before 2021 unemployment benefits counted toward your income and were taxed at rates according to the IRSs tax brackets.

. Get a free consultation today gain peace of mind. June 4 2019 226 PM. Tax Help Has Arrived.

Personal Property Tax Rate. People whose adjusted gross income was less than 150000 can exclude up to 10200 of unemployment benefits from taxes in 2020. New York which has the second highest unemployment rate in the country is one of just 11 states that is fully taxing unemployment benefits according to HR Block.

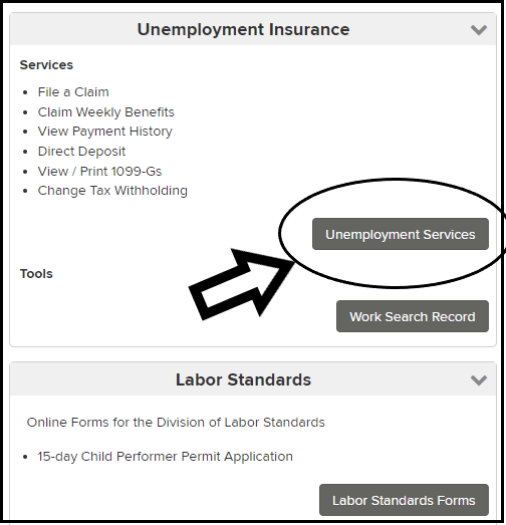

January 27 2021 753 AM. Dont Get Hit with Unexpected Tax Bill from Unemployment Insurance Payments New York State Tax Department shares money-saving resources to assist New Yorkers and. Ad Want Zero Balance Fresh Start.

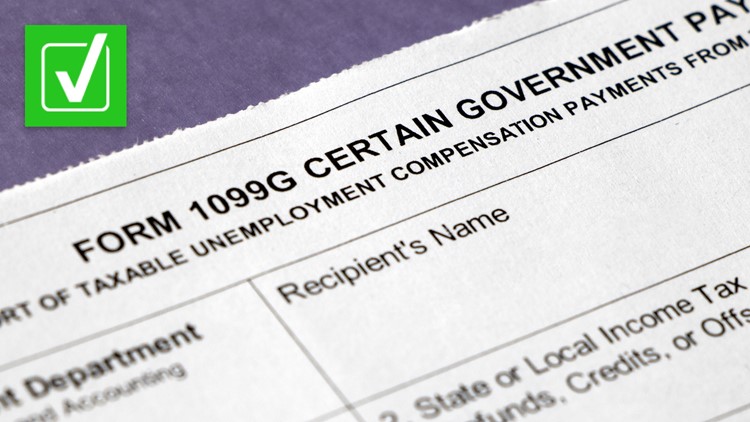

Last week we discussed the extent to which unemployment income is not taxed because of the American Rescue Plan Act. You should receive a Form 1099-G from your state or the payor of your unemployment benefits early in 2022 for the. If you owe state taxes and the state is paying you unemployment then they can garnish your benefits.

Generally you dont pay federal and possibly state. Over 19 million unemployment claims were filed in 2021 according to the Department of Labor. 31 2022 Published 723 am.

How much you owe will depend on how much income you collected last year -- from unemployment W2 employment freelancing investments etc. Premium federal filing is 100 free with no upgrades for unemployment taxes. The Treasury can garnish your Social Security or Social Security.

Ad Professional tax relief attorney CPA helping resolve complex tax issues. Despite recent significant payments to the federal Unemployment Trust Fund UTF New York is one of only seven states or territories with unemployment insurance UI. Every tax problem has a solution.

According to Experian you could be taxed federally on your unemployment insurance anywhere from 0 to 37 percent. Personal property taxes are due May 5 and October 5. See reviews photos directions phone numbers and more for the best Tax Return Preparation in Dulles VA.

When Gale Nichols received her tax forms last month she was in. If you did not pay enough taxes on your unemployment during the year you may have to pay additional taxes on it when you complete your tax return. Unemployment insurance benefits are subject to both federal and state taxes.

The IRS considers unemployment benefits taxable income When filing this spring your unemployment checks from 2021 will be counted as income taxed at your regular. Unemployment benefits received in 2021 are taxed as ordinary income like wages but are not subject to Social Security and Medicare. Get Tax Relief That You Deserve With ECG Tax Pros.

Yes they can take both state and federal refunds. At the federal level thats also true. The unemployment exclusion specifically said you didnt have to pay taxes on the first 10200 of unemployment compensation drawn in the year 2020.

State Unemployment Insurance Compensation debts are now eligible for referral to Treasury Offset. The American Rescue Plan Act of 2021 exempted some of that money from federal income taxes for tax year 2020. 100 free federal filing for everyone.

State Taxes on Unemployment Benefits. How Taxes on Unemployment Benefits Work. The regular rules returned for 2021.

They threw us to the fishes. However State Budget Director Robert. Assume that your company receives a good assessment and your.

In 2019 the taxable wage base for employees in Texas is 9000 and the tax rates range from 36 to 636. -- and what tax bracket. State Income Tax Range.

Release State Tax Levy Fast. Some Americans owe thousands in taxes on enhanced unemployment benefits. Unemployment compensation is considered taxable income by the IRS and most states thus you are required to report all unemployment income as reported on Form.

A vehicle has situs for taxation in the county or if it is registered to a county address with. Ad File your unemployment tax return free.

/1099g-b89de84cce054844bd168c32209412a0.jpg)

Form 1099 G Certain Government Payments Definition

Pin On Tax Planning In The U S

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Unemployment Taxes Will You Owe The Irs Credit Com

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Self Employed Tax Preparation Printables Instant Download Etsy Small Business Tax Tax Preparation Tax Prep Checklist

Fillable Form 940 2019 Irs Forms Fillable Forms Form

Do You Owe Taxes On Unemployment Benefits You Could Get Hit With A Big Tax Bill

2021 Unemployment Benefits Taxable On Federal Returns Abc10 Com

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Did You Collect Unemployment Benefits In 2020 Act Now To Avoid A Tax Day Surprise Dollars And Sense Abc10 Com

How To Get A Refund For Taxes On Unemployment Benefits Solid State

Is Unemployment Compensation Going To Be Tax Free For 2021 Gobankingrates

2021 Unemployment Benefits Taxable On Federal Returns Abc10 Com

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

2020 Unemployment Benefits Will Be A Factor When Your Taxes Are Due